average property tax in france

For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. How to file a tax return in France.

Households Up And Down England Are Being Slapped With The Biggest Council Tax I E Property Tax Hikes For 14 Years From 1 Ap Bills Property Tax Popular Bands

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

. This is a land tax and and is always paid by whoever owns the property on January 1st of any given fiscal year. France Residents Income Tax Tables in 2020. However there are reduced French TVA rates for certain pharmaceuticals public transport hotels restaurants and tickets to sportingcultural events.

This raised 323 billion in property taxes across the nation. Average price per hectare of free land and meadows in Brittany 2016-2018. And Social Charges which are currently 172.

This is the average yearly salary including housing transport and other benefits. Average single worker no children TAX WEDGE ON LABOUR INCOME Average tax wedge. Aggregate Local Property Tax Stats.

Taxes in France are high and the capital city is no exception. Points from 449 in 2019 to 454 in 2020. Property Taxes Taxe Foncière.

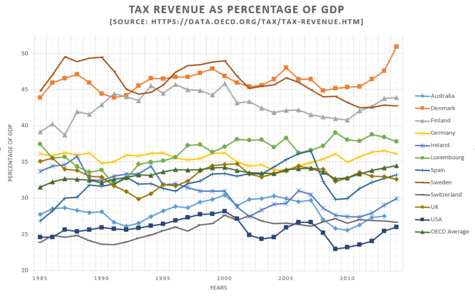

For properties more than 5 years old stamp duty is 58 or 509 in some departments. The tax-to-GDP ratio in France has increased from 434 in 2000 to 454 in 2020. Rental and related investment income from France and taxable in France beyond this level is taxed at 30.

In 2020 the average single-family home in the United States had 3719 in property taxes for an effective rate of 11. Like income tax property tax in France is a headache with the French apparently having a taste for making these processes as complicated as possible. The average monthly net salary in France is around 2 157 EUR with a minimum income of 1 149 EUR per month.

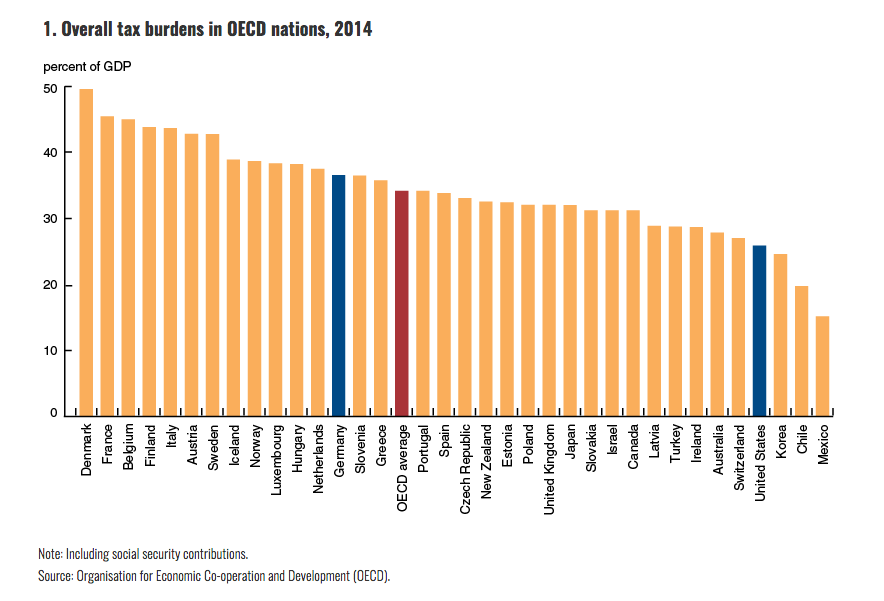

In 2020 France had the 4th highest tax wedge among the 37 OECD member countries compared with the 5th in 2019. The standard TVA rate in France is 20. Heres what you need to know about French property taxes including your tax-paying responsibilities tax rates and how to pay your property tax bills.

Property owners in France have two types of annual tax to pay. For new builds this rate is 2-3. This tax is actually comprised of the.

Income Tax Rates and Thresholds Annual Tax Rate. A person working as a Property Tax Assistant in France typically earns around 39500 EUR per year. Therefore to compare these two countries lets take the salaries of someone who gains 28 000 a year 45 000 a year and 113 000 a year and see how much they have left after taxes in each country.

Taxe sur la valeur ajoutée or TVA VAT in French is a tax on certain goods and services which is included in the sale price. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

For properties less than 5 years old stamp duty is 07 plus VAT at 20. For residents of France there is currently 19 tax on the resulting gain. Have you seen our French real estate buyers guide that comes with a 100 percent money back guarantee.

Remember tax rules in France change frequently. During that period the highest tax-. Salaries range from 18200 EUR lowest to 62800 EUR highest.

Obviously all countries have a different way of calculating taxes and different tax segments. One-earner married couple at average earnings 2 children. In 2020 the FNAIM Frances National Association of Estate Agents reported average national house prices of 2276 per square metre while this soars to over 10000 per square metre in the Paris region.

Taxes on goods and services VAT in France. Property Tax Assistant salaries vary drastically based on experience skills gender or location. Buyers in Paris will have to pay stamp duties on the purchase according to Jessica Duterlay a tax associate at Attorney-Counsel a.

Over the same period the OECD average in 2020 was slightly above that in 2000 335 compared with 329. ATTOM Data Solutions provides a county-level heat map. Between 2019 and 2020 the OECD average slightly increased from 334 to 335.

This places France on the 11th place in the International Labour Organisation statistics for 2012 after the United Kingdom but before Germany. For non-residents since 2015 the tax and Social Security payable on the sale of the property has been the same as for residents. The figure is based on the rental value of the property and the rate of tax is determined annually by the authority.

OECD average tax wedge in 2020 was 346 2019 350. There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in. As a result of simultaneous changes to the liability for social charges since 2019 the combined rate of social charges and income tax on French sourced income of EEA non-residents is 275 down from 372 provided the income does not exceed the above threshold.

In short location is the biggest factor affecting property prices. Check all the suggestions below with your English speaking French real estate professional. Unlike most EU member states France does not withhold income taxes from the monthly income although social.

Average price per hectare of free land and meadows in Ile-de-France 2016-2018. In 2019 homeowners paid an average of 3561 raising 3064 billion. If you purchase an older property anything older than 15 years youll pay between 7-10 of the propertys value in tax.

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Family Structure Matters More For U S Students Single Parent Families Single Parenting Family Education

Ecuador El Mejor Lugar Para Migrar Expat Destinations Infographic Ecuador Expat Cool Countries

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

When Is The Best Time To Buy A Home Mortgage Interest Rates Home Buying Home Mortgage

Explore Our Sample Of Office Moving Budget Template For Free Spreadsheet Template Report Template Computer Maintenance

A Two Speed Recovery Global Housing Markets Since The Great Recession Housing Market Global Home Global

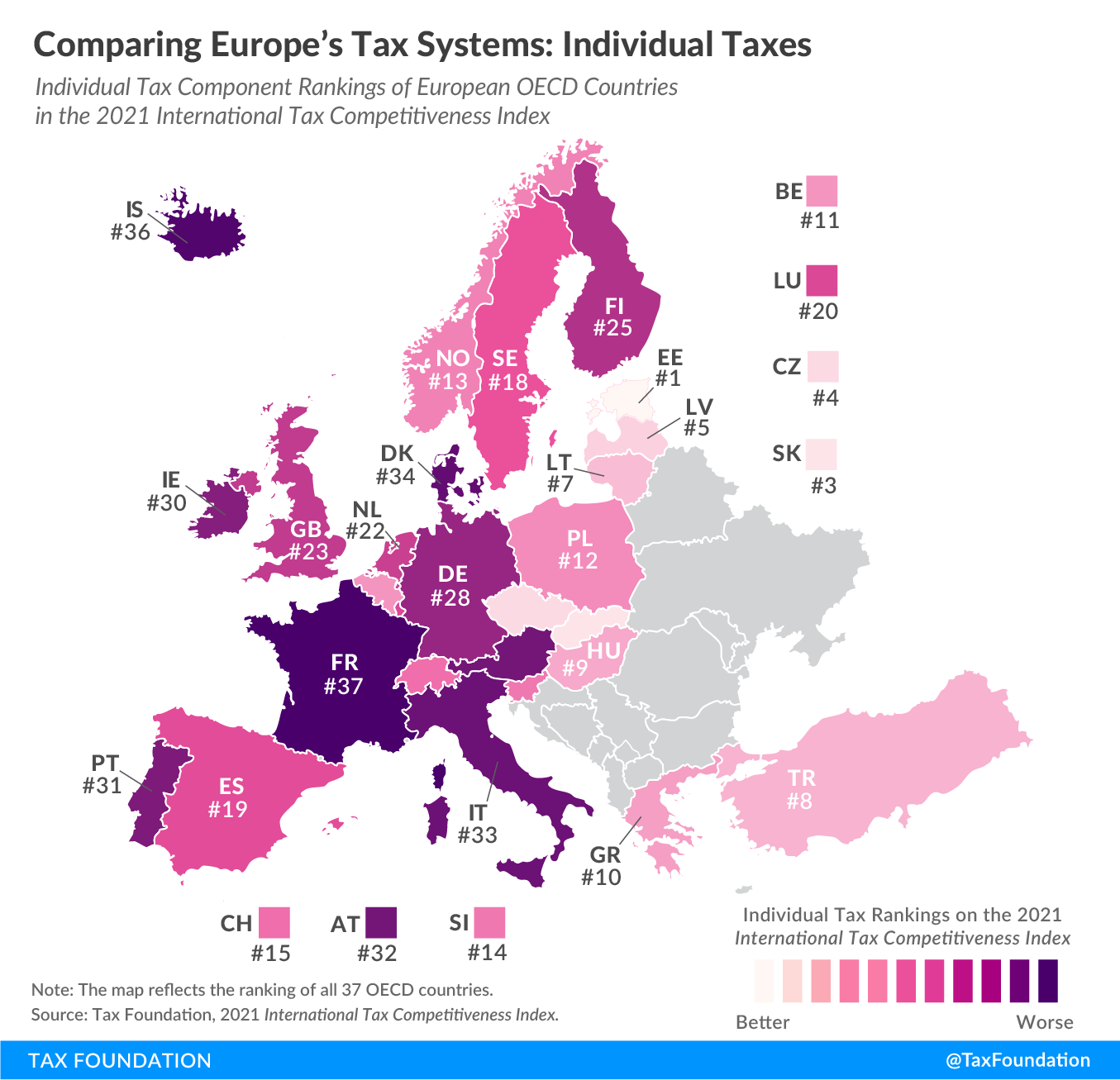

Comparing Income Tax Systems In Europe 2021 Tax Foundation

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Our Infographics Motivation Famous Motivational Quotes Motivational Thoughts

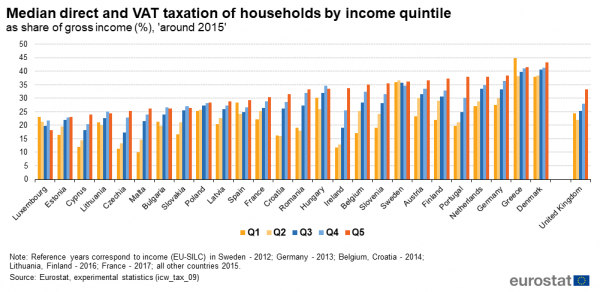

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Tax Day2015 Tax Day Real Estate Infographic Real Estate Fun

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

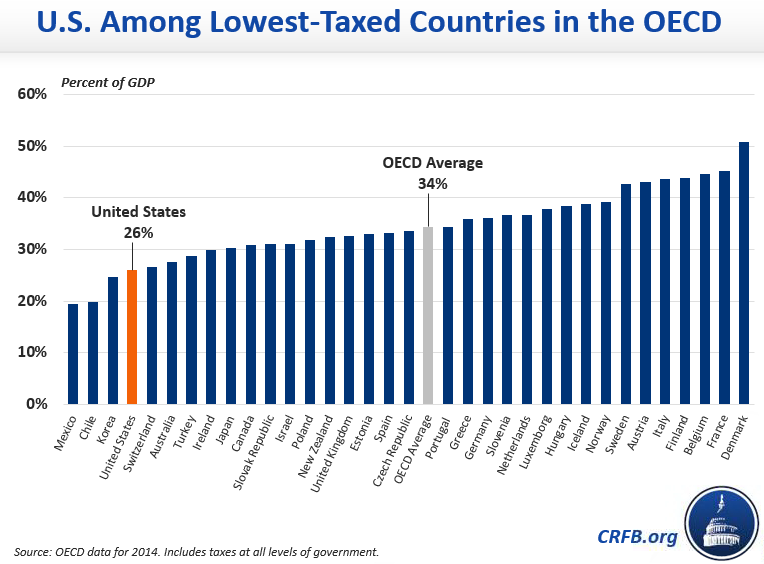

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget